This step shows the total impact on your budget due to changes in material costs. This process helps pinpoint where costs are not aligning with your financial plans and aids in maintaining control over spending. Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Keep an eye out for trends; if variances are often unfavorable, it might suggest problems with supplier pricing or purchasing practices that require attention. This clarity aids managers responsible for buying materials, like purchasing and warehouse managers, who need precise data for better sourcing decisions and negotiations with suppliers. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Can a positive variance be bad for my business?

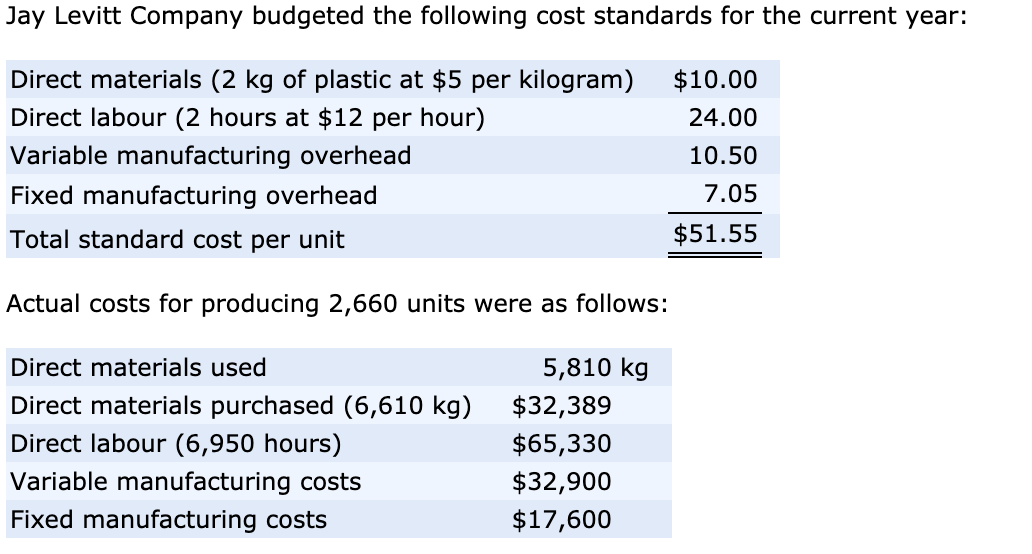

Materials price variance represents the difference between the standard cost of the actual quantity purchased and the actual cost of these materials. This year, Band Book made 1,000 cases of books, so the company should have used 28,000 pounds of paper, the total standard quantity (1,000 cases x 28 pounds per case). However, the company purchased 30,000 pounds of paper (the actual quantity), paying $9.90 per case (the actual price). Actual and standard quantities and prices are given in the following table for direct materials to produce 1,000 units. Total actual and standard direct materials costs are calculated by multiplying quantity by price, and the results are shown in the last row of the first two columns. If actual prices for materials are lower than budgeted, the variance is favorable.

- For example, a rush order is probably caused by an incorrect inventory record that is the responsibility of the warehouse manager.

- The difference of actual and standard cost raise due to the price change, while the material quantity remains the same.

- This suggests spending more and hints at possible issues with purchasing decisions or market changes.

- This year, Band Book made 1,000 cases of books, so the company should have used 28,000 pounds of paper, the total standard quantity (1,000 cases x 28 pounds per case).

Our Team Will Connect You With a Vetted, Trusted Professional

Managers can better address this situation if they have a breakdown of the variances between quantity and price. Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement. The total price variance during January is $ 200 ($ 400 – $ 300 + $ 100), and it will impact the cost of goods sold in statement of profit and lose. We can simplify the DMPV formula by multiplying the actual purchase quantity by the price difference, as shown below.

2: Direct Materials Cost Variance

The material price variance is adverse because the actual price is higher than the standard. The material price variance in this example is favorable because the company was able to get the materials at a lower cost compared to the budget. The standard price of $100 per bag was allowed in the budget, but the purchase manager was free estimate templates for word and excel able to source the materials from a cheaper supplier at the cost of $80 per bag. It could be because a company got a discount or faced a materials shortage. Maybe they switched to a new supplier or had to order materials in a rush and paid more. The term “standard price” refers to the cost you expect to pay per unit of material.

What is meant by standard direct material usage?

The direct material price variance can be meaningless or even harmful in some circumstances. For example, the purchasing manager might have engaged in heavy political maneuvering to have the standard price set unusually high, which makes it easier to generate a favorable variance by purchasing at prices below the standard. Consequently, the variance should only be used when there is evidence of a clear price increase that management should be made aware of. Since the price paid by the company for the purchase of direct material exceeds the standard price by $120, the direct material price variance is unfavorable. Calculate the direct material price variance if the standard price and actual unit price per unit of direct material are $4.00 and $4.10 respectively; and actual units of direct material used during the period are 1,200.

Standard direct material usage refers to the amount of materials allowed to be used per unit produced. One more, the favorable variance may arise from the purchase of low-quality material. The purchasing department and production manager need to do proper inspect all the material during delivery.

If a company’s actual quantity used exceeds the standard allowed, then the direct materials quantity variance will be unfavorable. This means that the company has utilized more materials than expected and may have paid extra in materials cost. Generally speaking, the purchase manager has control over the price paid for goods and is therefore responsible for any price variation. Many factors influence the price paid for the goods, including number of units ordered in a lot, how the order is delivered, and the quality of materials purchased. A deviation in any of these factors from what was assumed when the standards were set can result in price variance. Analyzing direct material variance is a powerful tool for businesses aiming to maintain cost control and enhance profitability.

A negative value of direct material price variance is unfavorable because it means that the price paid to purchase the material was higher than the target price. Material Price Variance is the difference between calculated forecasts of how much a material costs and how much that material costs during actual use. It’s a component of the broader concept of “material variance,” which includes both price and quantity variances. Material price variance analysis helps management identify areas for cost improvement, assess supplier performance, and evaluate the effectiveness of cost control measures. However, it’s essential to consider other factors that may influence costs, such as changes in material quality or production processes, when interpreting variance results. Materials price variance (or direct materials price variance) is the part of materials cost variance that is attributable to the difference between the actual price paid and the standard price specified for direct materials.

The direct material price variance is also known as the purchase price variance. The direct material price variance is also known as direct material rate variance and direct material spending variance. You use this part of cost variance analysis to help keep track of spending on materials. Getting a handle on these numbers can lead to better cost control techniques and purchasing decisions down the line. That way, when you crunch numbers for the direct material price variance formula, your results are spot-on. It’s not just about knowing the number of units but understanding their role in cost variance calculation too.

By understanding these trends, companies can anticipate future variances and take proactive measures to mitigate them. Once variances are identified, it’s essential to investigate their root causes. This involves looking beyond the numbers to understand the underlying factors contributing to the variances. For example, if a material price variance is detected, managers should examine market conditions, supplier performance, and procurement strategies to pinpoint the cause. Similarly, if a material quantity variance is found, a thorough review of the production process, employee performance, and equipment efficiency is necessary.

However, a favorable direct material price variance is not always good; it should be analyzed in the context of direct material quantity variance and other relevant factors. It is quite possible that the purchasing department may purchase low quality raw material to generate a favorable direct material price variance. Such a favorable material price variance will be offset by an unfavorable direct material quantity variance due to wastage of low quality direct material. Direct material price variance is the difference between what was actually spent on the raw materials purchased during a period and the standard cost that would apply if the materials were bought at the standard rate. To calculate the variance, we multiply the actual purchase volume by the standard and actual price difference. This calculation helps businesses understand the efficiency of their material usage and identify areas for improvement.